Right to Relief: Indebted Land Communities in Cambodia Speak Out

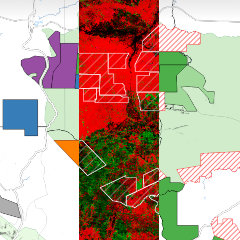

Published on 28 June 2021Right to Relief is a call for immediate action to be taken by microloan providers - both microfinance institutions (MFIs) and banks - as well as their international investors, including state development banks from Europe and the United States, to investigate the scope of human rights abuses and provide relief to borrowers who have suffered from predatory lending and collection practices. The research spans eight provinces in Cambodia, with each community profile featuring information about the community’s formation in response to a land conflict, and the threat to land tenure security and other human rights now posed by over-indebtedness.

A newly-released website features highlights from the 14 community profiles, while a PDF of the report contains more complete profiles and additional information about the project.

As of December 2020, there were 2.8 million loans in Cambodia tracked by the Cambodian Microfinance Association (CMA), totaling $11.8 billion dollars. These include loans from registered MFIs as well as the “small” portfolio of several Cambodian banks. Among these “microloans”, the average size of a loan was $4,280 – a staggering figure that is higher than 95% of Cambodians’ annual income. This reckless growth has led to widespread over-indebtedness, and much of this portfolio is collateralised with borrowers’ land titles. As shown in previous research by local human rights NGOs, MFIs in Cambodia charge high interest rates, require land titles as collateral, and target poor clients who are vulnerable to land loss. These predatory practices have led to immense profits for MFIs and their foreign lending partners and have negatively impacted the land tenure security of Cambodians, especially vulnerable communities.

This research also shows that the options provided by banks and MFIs for restructuring or delaying microloan repayments during COVID-19 are insufficient and have failed to stop coerced land sales or other abuses from occurring during the global pandemic, when many Cambodians’ incomes fell, affecting their ability to repay.

Options provided by banks and MFIs for restructuring or delaying microloan repayments during COVID-19 are insufficient and have failed to stop coerced land sales or other abuses from occurring during the global pandemic

Communities that participated in this research struggle against a number of abuses due to their microfinance debt. Widespread reasons for taking loans included repaying other debt, healthcare, building a house, agriculture, and paying for a child’s education. Widespread consequences of microloans included needing to borrow from private lenders, eating less food, selling possessions, selling land, child labour, and debt-driven migration. Meanwhile, credit officers who operate in these communities engaged in aggressive lending and collection practices, pressured land sales, issued threats to borrowers who were late on repayments, and encouraged the use of private lenders.

These communities have all faced land conflicts in the past related to companies or powerful individuals who pushed them off their land. Many of these conflicts stem from the more than 2 million hectares of land that the government granted to private corporations in the form of Economic Land Concessions (ELCs). This research shows that after years and, in some cases, more than a decade of struggling and advocating for their land rights, communities’ land tenure security is now threatened again by the over-indebtedness crisis in the microloan sector.

Without the right to relief, borrowers will continue to face debt-driven hunger, child labour, migration, coerced land sales, and many other human rights abuses.

MP3 format: Listen to audio version in Khmer

- Topics

- Land Rights Microfinance/Debt