Collateral Damage: Land Loss and Abuses in Cambodia's Microfinance Sector

Released in August 2019| Download this report in English (PDF, 8.38 MBs) | |

| Download this report in Khmer (PDF, 7.87 MBs) |

More than 2 million Cambodians currently have a loan with a microfinance institution, or MFI. Levels of debt have skyrocketed in recent years, leading to a number of human rights abuses, including coerced land sales, child labour, debt-driven migration, and bonded labour, according to a joint report from the Cambodian League for the Promotion and Defense of Human Rights (LICADHO) and Sahmakum Teang Tnaut (STT).

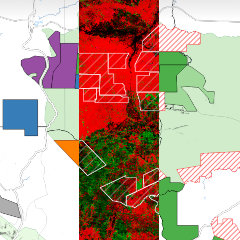

Collateral Damage: Land Losses and Abuses in Cambodia’s Microfinance Sector details the size and scope of Cambodia’s MFI sector and seeks to highlight the human rights abuses that researchers discovered. The research spans 10 communes in 4 provinces as well as Phnom Penh and features seven detailed case studies of abuses, chosen from the 28 MFI clients who suffered human rights abuses that were interviewed by researchers.

MFIs in Cambodia charge high interest rates, require land titles as collateral, and target poor clients who are vulnerable to land loss. This predatory form of lending, which has led to immense profits for MFIs and their foreign lending partners, has negatively impacted the land tenure security of Cambodians, especially vulnerable communities.

Poor farmers should not be subjected to predatory financial activity, but rather have access to sustainable and community-managed financing. LICADHO and STT call on the Cambodian government, microfinance institutions and international investors to reform these practices and ensure that Cambodians are no longer forced to sell land and suffer human rights abuses in order to pay their debts.